starting credit score at 18

November 18 2022. To begin your credit-building journey consider opening a.

What S My Credit Score Why It S Critical To Know This Three Digit Number Moneylion

For example Discover requires that authorized users be at least 15 years.

. Understand the basics of credit. This is credit score 101. These seven tips will guide you through how to start building credit at 18.

The average credit score for an 18-year-old the age at which most Aussies will sign their first contracts and start establishing a credit history is only 424. Getting a credit card for the first time is one of the best ways to build credit at 18. Most cards allow authorized users younger than 18.

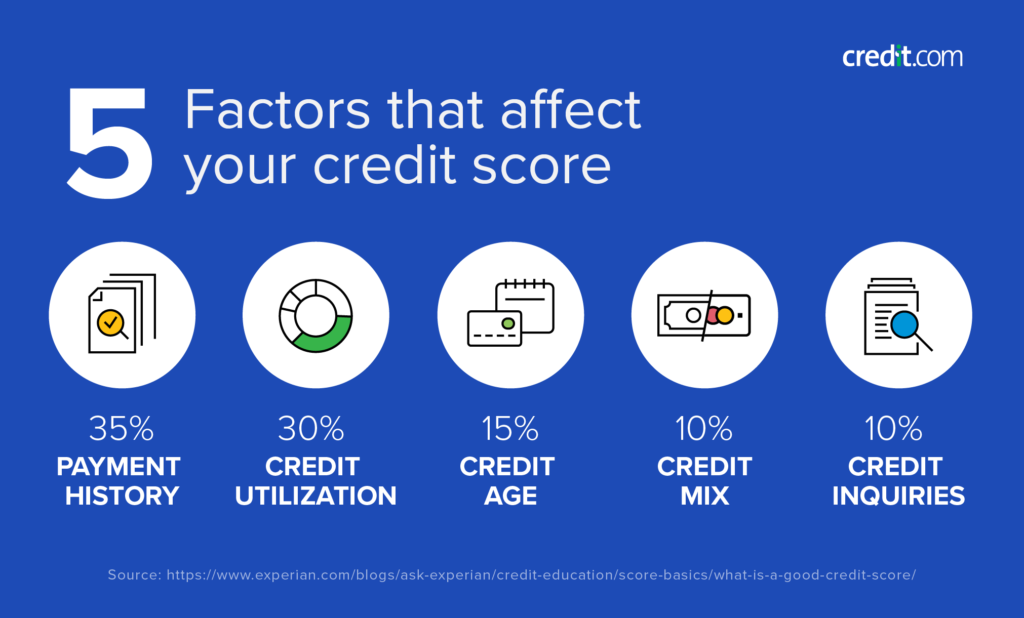

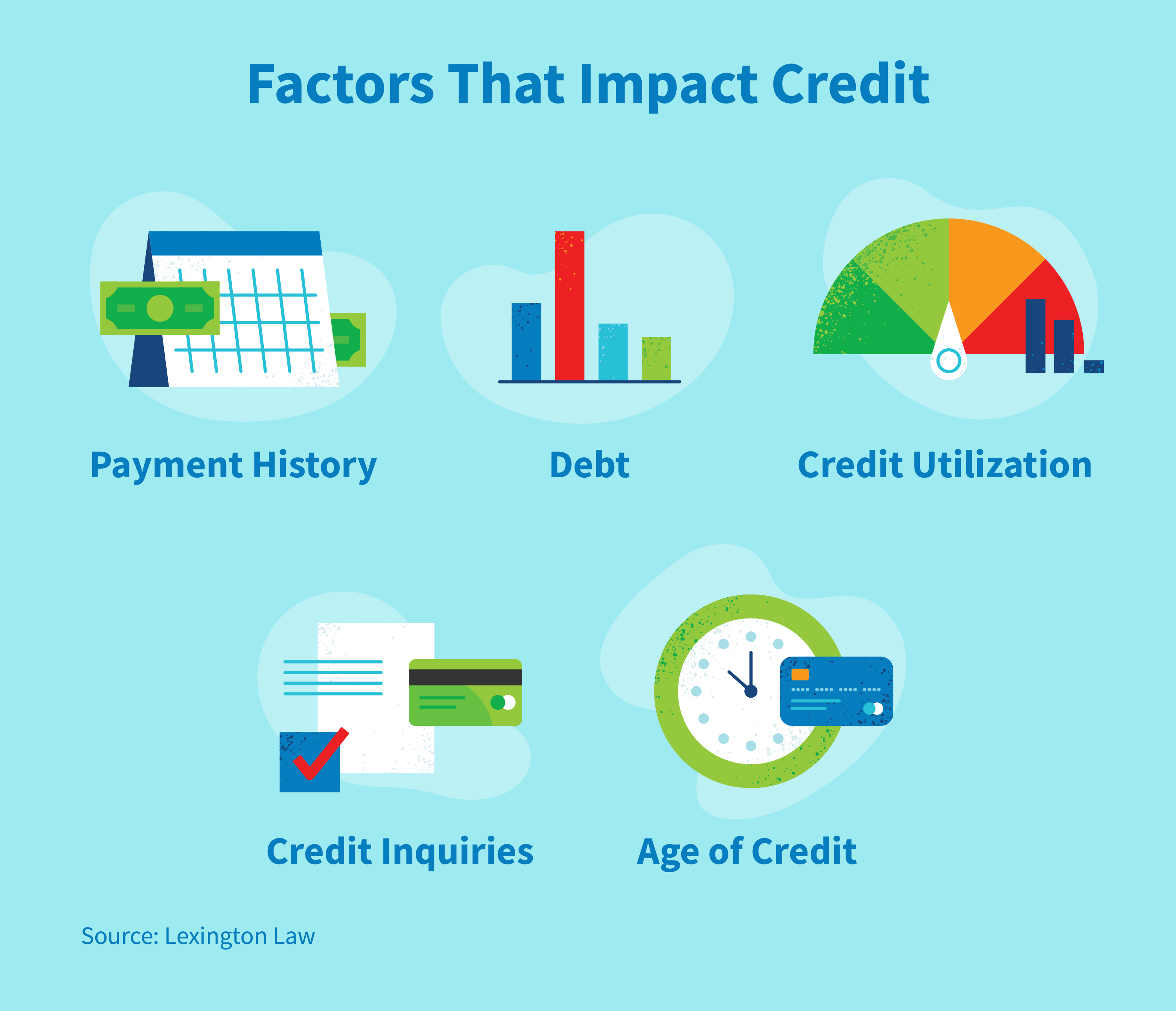

Your payment history makes up the biggest chunk of your credit score - 35 percent. Make payments on time all the time. Is a 631 credit.

As a recent report by the. Some have age minimums while others dont. The credit history you start with at 18 is a blank slate.

Credit bureaus will not automatically assign you a score once you reach adulthood. Your credit score and history can also helpor hinderyou when youre applying for certain types of employment a new apartment utilities or auto insurance. The Bottom Line.

This is typically peoples first go-to method because it is a guaranteed way for starting a credit. There are multiple ways to start building a credit score once you turn 18. When consumers turn 18 they do not get a specific score by default.

The credit bureaus only give you a score once. Before you do anything. The truth is that theres no single starting credit scorewhere you start depends on your actions when you begin using credit.

And its free for everyone not just Capital One customers. You dont start with a credit score at 18. Getting into the habit of always paying.

However it is possible to get a credit score above 850. Using CreditWise to keep an eye on your credit wont hurt your score. The average credit score for an 18-year-old the age at which most Aussies will sign their first contracts and start establishing a credit history is only 424.

It requires a history so there is nothing to assess until you start borrowing and make. Most credit scores range from 300 to 850 with the average credit score being around 680. Building credit at 18 is an essential part of adulthood.

If youre wondering how to build credit at 18 you can get a credit builder loan a student loan student. 4 hours agoWith about nine million active credit accounts Gen Z has driven lenders to create more robust underwriting models that go beyond credit scores. For FICO Scores the most commonly used credit score here are the credit score ranges.

Your credit score doesnt exist until you start building credit. You can also get free copies of your credit.

Build And Improve Your Credit Score In Any Situation Opencashadvance

Higher Dimensions Financial Services Warrenville Il Facebook

Approved For Chase Sapphire Preferred Myfico Forums 5990920

What Credit Score Do You Start With Bankrate

18 Last Time Francis Checked Her Credit Score Was 659 Since Then She Applied For A Store Credit Brainly Com

How To Build Credit Once You Turn 18 Money Under 30

How To Build Credit At 18 Financebuzz

What Is A Good Credit Score Forbes Advisor

Credit Scores Why Fico Scores Hit All Time High During Pandemic

What Is The Starting Credit Score Blonde And Balanced

How To Build Your Credit At 18 Credit Sesame

How To Start Building Credit At 18 Credit Cards U S News

The Starting Credit Score A Guide For Beginners Internet Vibes

What Is The Average Credit Score In America Credit Com

How Long Does It Take To Raise Your Credit Score Bankrate

How To Start Building Credit When You Turn 18 Creditrepair Com

How To Build Credit Once You Turn 18 Money Under 30

What Does Your Credit Score Start At Repair Credit Quick

American Express American Express Launches Score Goals To Help U S Consumers Improve Their Vantagescore 3 0 Credit Score By Transunion